As the dollar values go up, the stakes for authentication get higher. And as standards of authentication grow stronger, the dollar values tend to go up.

This chicken-or-the-egg conundrum is a driving force behind the maturation and increased sophistication of various collectible categories. Often though, it is the egg, or in this case, more rigorous standards of authentication, that takes a collectible asset class into a new price tier.

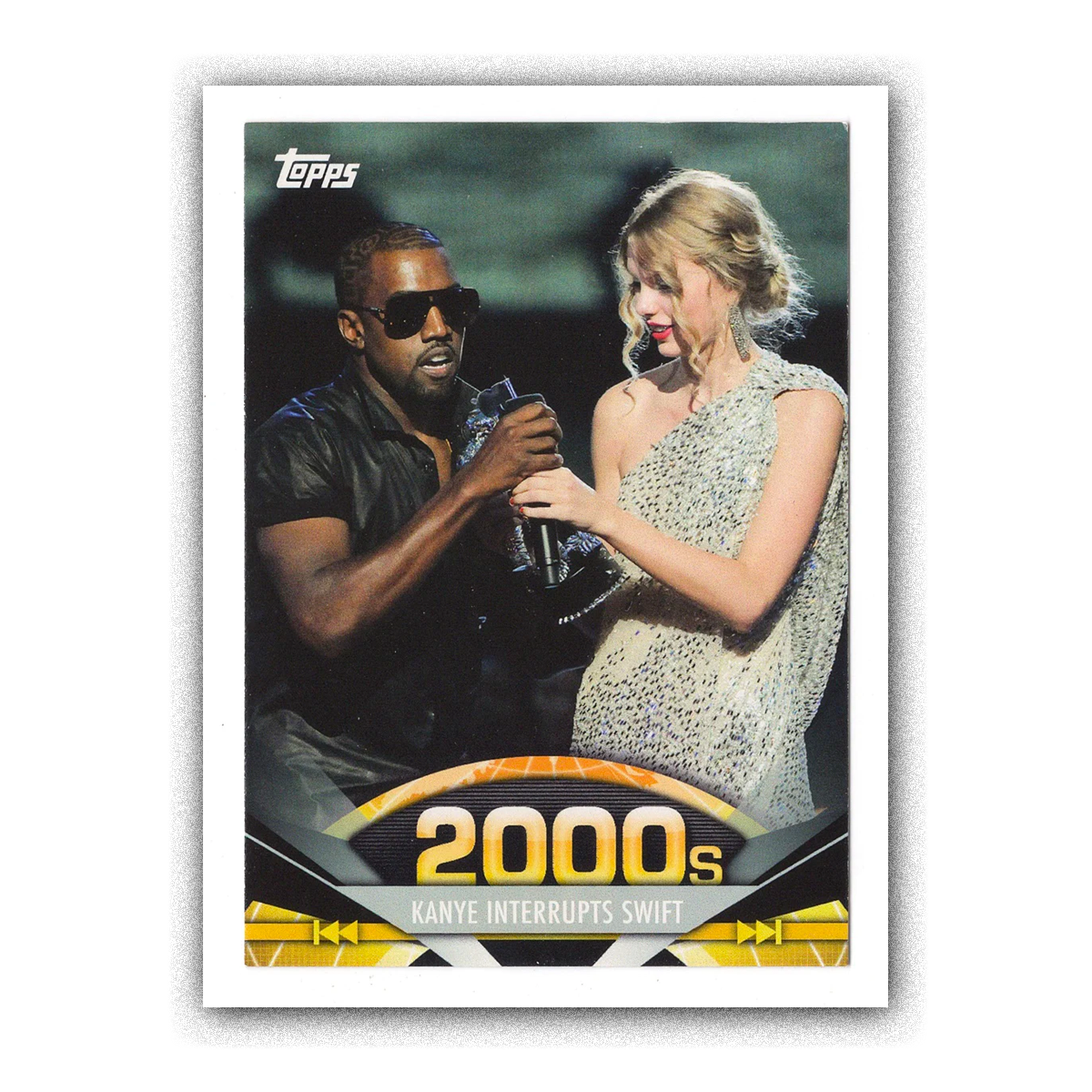

Love it or hate it, card grading played an immense role in elevating card collecting from a pure children’s hobby to a booming marketplace. While card authentication and grading is certainly important, ultimately, what’s authenticated is whether or not cardboard is indeed a certain type of cardboard, printed in the right factory by the right manufacturer. We don’t mean to minimize those stakes, but in comparison to verifying whether an item was actually worn or held by a person of influence, it starts to sound quite trivial.

The value of a memorabilia item – whether in sports, music, film, or history – is based in its interaction with the person. Without that interaction being verifiable, the value is severely impaired. As you quickly learn by studying memorabilia markets, verifiability – at least to date – is not a binary quality. It lives on more of a spectrum, with some sources of authentication offering greater credibility than others, and others offering greater credibility than no authentication at all.

For the longest time in most memorabilia categories, effectively the only standard of authenticity was LOA or COAs. An LOA (letter of authenticity) is a written assertion accompanying a piece of memorabilia, affirming that the memorabilia was indeed used or worn by the person of interest.

It might come from the person themselves, a manager, a family member, or someone else somehow affiliated with the person or the moment. It might already be apparent: credibility of the signer declines quickly as degrees of separation from the person themselves increase. Unfortunately, it’s more often the case that an LOA comes from some tangential party rather than the actual person, weakening the strength of the authentication to begin with.

Then, there’s the fact that this piece of paper is in no way inextricably linked to the item itself. There are typically no incontrovertible identifiers tying the item to the LOA. Put more simply, there’s plenty of room for shenanigans. The risk only increases the further away in the chain of provenance the item gets from that initial LOA signer.

As prices for memorabilia swelled into six-figures throughout the 1990s, the increasingly lucrative market was in desperate need of better authentication protocols. Demand for concert-played guitars and game-worn jerseys became so significant that federal agencies started policing as much as their budgets would allow. Their work, while limited in both scope and scale, provided some of the first data-backed estimates on just how fraudulent the memorabilia sector was. Take for example, an FBI report released in the late 1990s that estimated between 50% – 60% of all memorabilia sold across secondary markets was, in fact, fake.

Let’s use sports as an example to understand how authentication has evolved. The use of LOAs and COAs was common, but then specialists emerged to provide more rigor around evaluation of an item’s use. MEARS is a well known provider in this space, examining an item to see if it matches the material that would’ve been used by a player or team at that specific point and evaluating it for characteristics that exhibit game use. Generally, where these evaluations fall short is pinpointing specifically the games in which a jersey was worn or a bat used, unless that information is highly verifiable via provenance. In terms of visual confirmation, though, it’s somewhat limited.

Enter photomatching. Using high-resolution images – typically from a reputed provider like Getty Images – a photomatching service will deeply examine the material worn by a player in a specific game and compare that to the material in hand. They’re looking at extremely intricate details like thread placement, mesh hole patterns, blemishes, and markings to conclusively determine that the piece of memorabilia is the very same one worn or used in the photo. The proliferation and acceptance of these services has recently pushed the sports memorabilia market to new heights.

In 2022, the top 25 game-worn or used sports memorabilia auction sales were up an astonishing 118% over 2021.

A big factor in that rise? The ascendancy of photo-matched material. Of those top 25 items sold in 2022, 19 were advertised as being photomatched. This meant a far greater number of jerseys and uniforms reaching new heights than in years prior. In fact, just one year before, the difference in results was stark.

Of those top 25 items in 2021, only 11 of them were advertised as being photomatched. Absent a greater volume of high-quality photomatched material, it was items like vintage, game-used bats that took up a significant swath of the rankings. This is not surprising, as those items also feature a well-known and well-regarded authentication standard from PSA/DNA. Absent stronger authentication, seemingly high-quality items like a Larry Bird rookie jersey and a Kobe Bryant rookie sneakers find themselves outside of the top 25, relying on MEARS authentication or provenance alone.

While it’s difficult to pinpoint perfectly apples-to-apples comparisons, here’s an illustrative example of the difference in results for rigorously and less rigorously authenticated material. In June of 2022, a photomatched, signed, and inscribed 1998 Michael Jordan jersey sold for $540,000. Three months later, a signed game-worn jersey from the same season with robust signature authentication but no photomatching sold for just $74,400.

The raising of the bar isn’t exclusive to sports. At this year’s Propstore Entertainment Memorabilia Live Auction, despite there being 20% fewer lots than last year overall, 94 lots featured “screen-match” in their title versus just 33 in 2022. That event featured significantly more depth of strong results than the year prior.

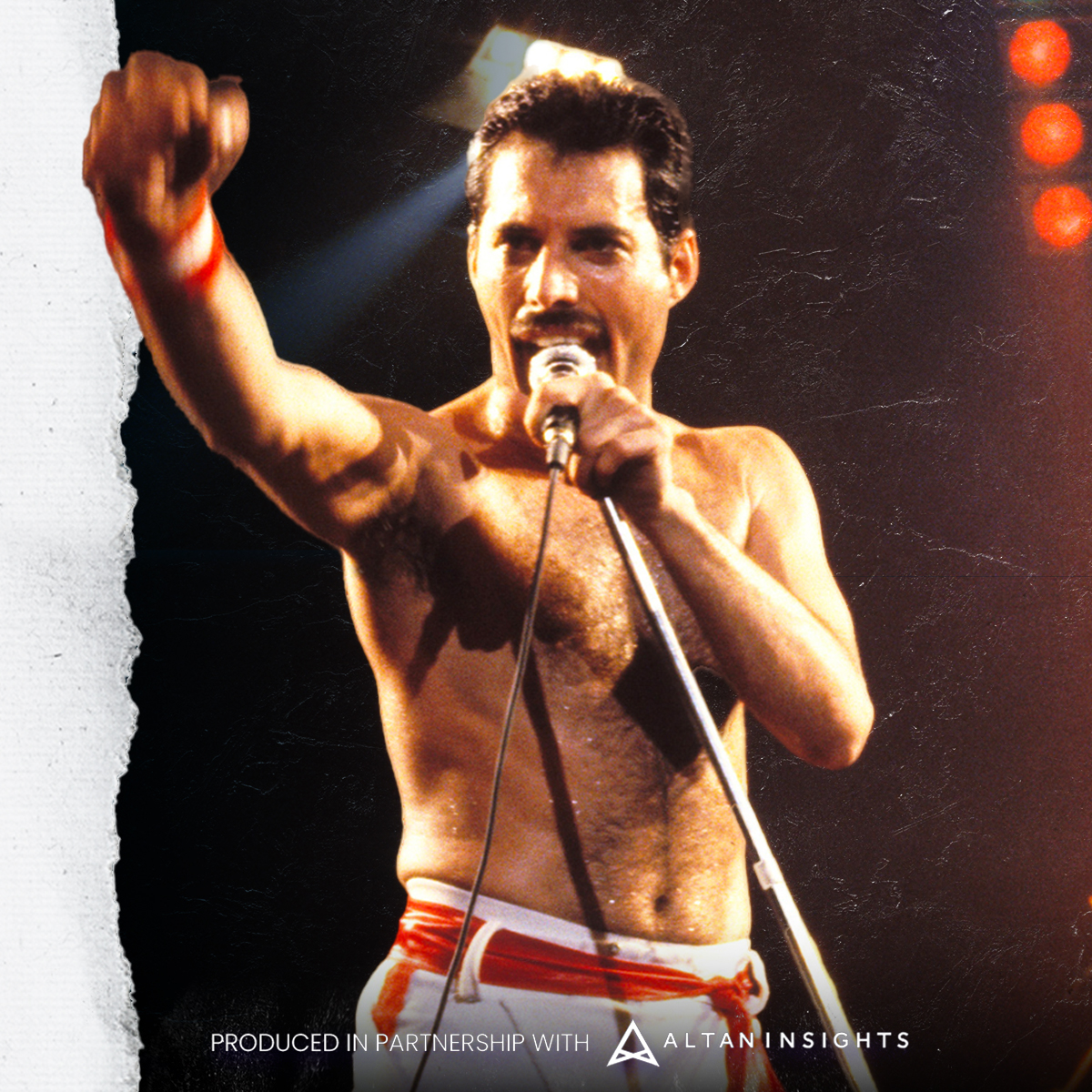

The point here isn’t to exalt photomatch or screenmatch authentication as the one and only viable method, but rather to show how a market can take to new levels when a more stringent standard is applied. Music memorabilia is certainly a category in need of greater stringency.

To date, it’s been host to a preponderance of LOA-based authenticity, with a smattering of amateur photomatching. There is no clear standard that has elevated the space, leaving most items to trade a lot like that LOA-based Jordan jersey: money left on the table. Worse, provenance is often murky, further complicating things.

The increased circulation and sales volume through the 20th century has only muddied the waters for those committed to improving the integrity of these large markets. If more than half of all music memorabilia sold in the 20th century was fake as the FBI report suggested, how can auction house provenance be trusted as a primary source of authentication? In the 2010s, PSA/DNA released shocking estimates that only 6% of all autographed Beatles memorabilia sent to the company is actually authentic while more than 75% of all Elvis signatures submitted were forged.

Today, multiple Kurt Cobain-used guitars have sold for seven-figures, but that market was born from humble beginnings. As the music memorabilia market – and the market for these rare and prized strings – materialized in the early 2000s and 2010s, a greater number of collectible Cobain guitars took to the auction block. One such example emerged in 2007 when a 1953 Martin Acoustic appeared on the block at a major auction house. The mid-century guitar was said to be Cobain’s first Martin D-18, which would become his preferred acoustic brand throughout the 1990s. The auction lot description mentioned that Cobain’s then girlfriend, Mary Lou Lord, had sold the guitar to a collector, and its authenticity was backed by a grainy color photo of Cobain playing the guitar.

What should have been a breakout sale was shrouded in unanswered questions. For starters, Mary Lou Lord stated that she had gifted the real original D-18 to Cobain before sharing it with other artists after his tragic death in 1994. Lord also stated that the guitar was not actually sold but instead donated to the Martin Museum. Additionally, the grainy photographs showed differences in the guitar’s features and wear. Worse, in the photo, Cobain is holding the guitar left-handed, but it’s strung right-handed. Collectors clearly had their concerns, and the guitar only sold for $29,875 at a time when expectations would have valued the memorabilia in excess of $80,000.

Anecdotes like this one had become all too commonplace in the industry. After years of a ‘wild west’ market, collectors now called for substantial evidence to support claims made by sellers, and without it, prices would hit a ceiling.

It’s only when an item is able to be verifiably “placed” on the celebrity, athlete, or performer that a greater number of bidders have a greater amount of confidence to engage. Nobody wants to spend five-figures on a Michael Jackson glove only to be left wondering if they were duped by a Smooth Criminal. You’d have to look at the Man in the Mirror after a decision like that.